Source: Research and Markets

Dublin, March 24, 2025 (GLOBE NEWSWIRE) -- The "Credit Card Issuance Services Market Report 2025" has been added to ResearchAndMarkets.com's offering.

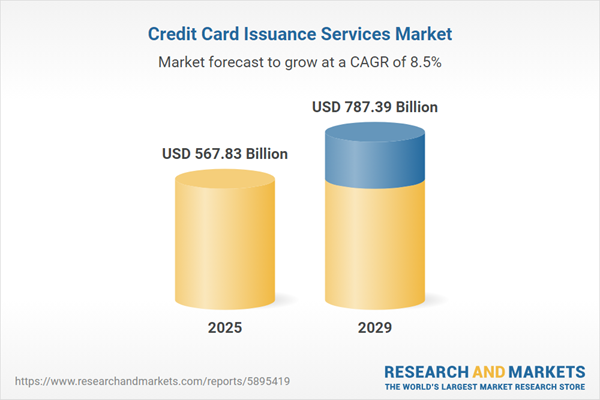

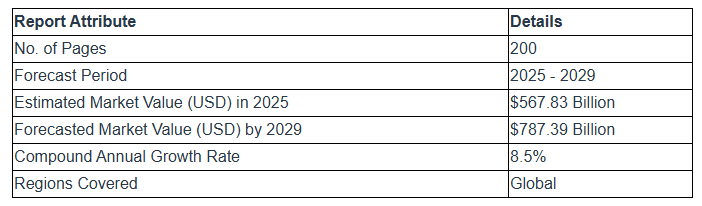

The credit card issuance services market size has grown strongly in recent years. It will grow from $520.01 billion in 2024 to $567.83 billion in 2025 at a compound annual growth rate (CAGR) of 9.2%. The growth in the historic period can be attributed to consumer spending patterns, financial inclusion initiatives, economic growth, loyalty programs, and regulatory changes.

The credit card issuance services market size is expected to see strong growth in the next few years. It will grow to $787.39 billion in 2029 at a compound annual growth rate (CAGR) of 8.5%. The growth in the forecast period can be attributed to contactless payment adoption, data security concerns, the emergence of cryptocurrencies, the rise of embedded finance, customization and personalization. Major trends in the forecast period include biometric authentication, integration with financial wellness services, real-time payment processing, blockchain for security, and AI and predictive analytics.

The anticipated growth in the credit card issuance services market is expected to be driven by an increasing demand for credit cards. Credit cards, offered by banks as credit products, enable users to access loans up to a pre-approved credit limit. Credit card issuers play a crucial role in processing card transactions, managing repayments for approved purchases, and handling chargeback requests. For example, in February 2023, the Federal Reserve Bank of New York reported that credit card balances in the USA rose by $61 billion to reach $986 billion in the fourth quarter of 2022, surpassing the pre-pandemic peak of $927 billion. Consequently, the upsurge in credit card demand is a key factor propelling the growth of the credit card issuance services market.

The expansion of e-commerce is poised to contribute to the growth of the credit card issuance services market in the foreseeable future. As of November 2023, according to the United States Census Bureau, e-commerce sales are projected to increase by 7.6 percent (1.2%) compared to the same period in 2022, with total retail sales increasing by 2.3 percent (0.4%). E-commerce sales are expected to constitute 15.6 percent of overall revenues in the third quarter of 2023. Hence, the surge in e-commerce growth remains a driving force behind the credit card issuance services market.

Technological advancements are a significant trend gaining traction in the credit card issuance service market. Major companies in this sector are developing new technologies to maintain their competitive edge. For example, in April 2024, AU Small Finance Bank, an India-based banking institution, launched two new credit cards: the Secured Credit Card - NOMO (No Missing Out) and the AU SPONT Rupay Credit Card. The NOMO Credit Card is aimed at individuals who may not qualify for traditional unsecured credit cards due to reasons such as a lack of credit score, limited credit history, or insufficient proof of income. It offers distinctive benefits, including reward points, fuel surcharge waivers, and airport lounge access. Meanwhile, the Rupay Credit Card is notable for allowing users to link it to their preferred UPI-enabled app, facilitating seamless payments through the UPI Scan and Pay feature. Additionally, it provides 1% cashback on most transactions and COINS rewards for UPI transactions made via the AU 0101 application, making it accessible to customers across all income levels.

Major companies in the credit card issuance services market are adopting a strategic partnership approach to enhance credit access for newcomers. In September 2023, HSBC UK Bank plc, a UK-based banking and financial services organization, announced a partnership with Nova Credit, a US-based cross-border credit bureau. This partnership enables immigrants to include their overseas credit history when applying for a credit card with HSBC UK. The collaboration with Nova Credit, the world's first cross-border credit agency, allows newcomers in the UK to utilize their overseas credit history efficiently and at no cost when applying for an HSBC UK credit card. Customers applying for an HSBC UK credit card online can share their credit history from a growing list of 12 countries, including the United States, Brazil, Canada, Australia, the Dominican Republic, Kenya, India, Mexico, Nigeria, the Philippines, Switzerland, and Spain.

In March 2023, Clal Insurance, an Israel-based insurance company, acquired Max Credit Card for $687 million. This acquisition allows Clal Insurance to establish a presence in the Israeli credit market, strengthening its position in the consumer credit sector. Max will be integrated into Clal's operations, becoming a part of its insurance and finance business, thereby enhancing competition in the market. Max is a provider of credit card insurance based in Israel.

Report Scope

The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market's historic and forecast market growth by geography. North America was the largest region in the credit card issuance services market in 2024.

Markets Covered:

2) By Issuers: Banks; Credit Unions; Non-Banking Financial Companies

3) By End-User: Personal; Business

Subsegments:

2) By Business Credit Cards: Small Business Credit Cards; Corporate Credit Cards; Commercial Credit Cards; Business Rewards Credit Cards; Charge Cards

Key Companies Profiled: JPMorgan Chase & Co.; Bank of America Corporation; Citigroup Inc.; American Express Company; HSBC Holdings plc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Key Attributes

Some of the major companies featured in this Credit Card Issuance Services

market report include:

JPMorgan Chase & Co.

Bank of America Corporation

Citigroup Inc.

American Express Company

HSBC Holdings plc.

Toronto-Dominion Bank Group

Goldman Sachs Group Inc.

Capital One Financial Corporation

Barclays Bank PLC

U.S. Bancorp

Standard Chartered PLC

PNC Financial Corp.

Fiserv Inc.

Synchrony Financial

Fidelity National Information Services Inc.

Stripe Inc.

Wells Fargo & Co.

Fifth Third Bank NA

Navy Federal Credit Union

Huntington Bancshares Incorporated

Santander Bank N.A.

Giesecke+Devrient GmbH

Synovus Financial Corp.

Penfed Federal Credit Union

Marqeta Inc.

Entrust Corporation

Comenity Bank

Nium Pte. Ltd.

For more information about this report visit

https://www.researchandmarkets.com/r/mkbzdq

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.